Need for Flood Insurance California

Floods pose a severe threat to California, but only a few residents prefer to purchase coverage for insurance despite the fact that California flood insurance provides protection from devastation and destruction caused by natural hazards. In the absence of flood insurance in California, losses incurred can be catastrophic. California flood insurance offers you extra protection against floods caused by

• storms

• melting snow and ice

• hurricanes

• insufficient drainage systems

Flood Threat to California Cities

• Bakersfield

No matter in which part of California you reside, your home is vulnerable to flooding. If you live in Bakersfield, flood insurance is a necessity, since the city hosts some historical flood areas that are prone to flooding by heavy downpour and melting snow from the surrounding mountains. As a Bakersfield homeowner, you must protect your home and personal assets from any kind of flood any damage caused by flooding.

• Yuba City

Though levees guard Yuba City against the surge in the Sacramento and Feather Rivers, they are only the first defence against river flooding and don’t offer full protection. Therefore, flood insurance in Yuba City is offered as an alternative to disaster assistance aimed at mitigating the escalating cost of flood damage. In Yuba City, flood insurance is available to homeowners, business owners, renters through federally backed programs, since it participates in the NFIP. We also have private flood insurance carriers that compete with FEMA’s flood program.

• Redding

Before buying a home or commercial building in Redding, check whether your property falls in or out of the special flood hazard area. Go for Redding flood insurance even if your property lies is in the low flood risk zone, as floods pose a great threat to your home and savings and are capable of incurring huge losses if you are not covered by a flood insurance policy.

• Stockton

Stockton flood insurance is the best option to safeguard your property, electrical and plumbing system, furnaces, air-conditioning equipment, water heaters, refrigerators, dishwashers, cooking stoves, and expensive carpeting in the event of flooding, since there is a risk of widespread local flooding in the city from heavy rains and even levee failures in the San Joaquin River.

• Visalia

With the weather patterns drastically changing, it would not be wrong to say that flooding in Visalia is not a rare possibility. In fact, Visalia flood insurance maps were changed drastically in 2009. If you think it is better to pay for the damage to your homes personally rather than paying for Visalia flood insurance, you are seriously wrong, as flood hazard can be a costly disaster.

• Merced

Merced flood insurance is the perfect investment for you if you are a resident of this part of California, since even a few inches of rain can cause devastation, costing you hundreds of dollars in repair. With a flood insurance policy in hand, you are protected from financial loss caused by floods.

• Modesto

While a home in Modesto can give you perfect bliss amid the culturally diverse atmosphere, you must also be aware of the risk posed by floods to the area. Since your homeowners insurance does not include coverage against damage from hurricanes, tornado, and floods, Modesto flood insurance thus becomes important to keep your home, business, and possessions safe and secure.

• Chico

Though northern Chico has been protected by levees and flood-controlled structures, the risk from rising rivers cannot be negated. Homeowners having Chico flood insurance are protected against losses resulting from heavy rains, storm surges, snow melts, blocked storm drainage systems.

Contact us to get cheap and affordable California flood insurance quotes for Chico, Bakersfield, Stockton, Modesto, Visalia, Merced, Redding, and Yuba City, among other cities.

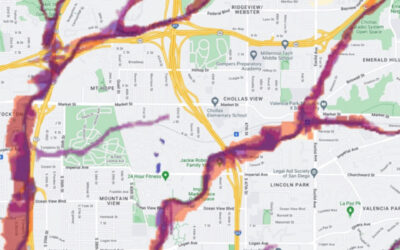

Our new program can save you thousands of dollars if you reside in a flood zone such as A or AE on the flood zone map.

Call us Toll Free (855) CAL-FLOOD (225-3556) or look us up at www.californiafloodinsurance.com

Loss of Use Coverage in Flood Insurance

By Aaron J. Farmer The Essential Benefit of Loss of Use Coverage in Flood Insurance When considering flood insurance,...