Though a home in a high risk zone is five times more vulnerable to flood damage, it does not mean homes in the moderate to low risk zones have no chance of being flooded. In fact, the risk of flooding is reduced in these zones, but not completely removed. Actually, if you go by the National Flood Insurance Program (NFIP) statistics, these areas submit about 25 percent of the claims received by the NFIP and receive about one-third of flooding assistance. Though flood insurance isn’t compulsory in low-to-moderate areas, unlike high risk zones, it is recommended that all property owners and renters have a flood insurance policy so that in times of unforeseen flooding, they can file a claim for the damages.

What if your flood risk seems low?

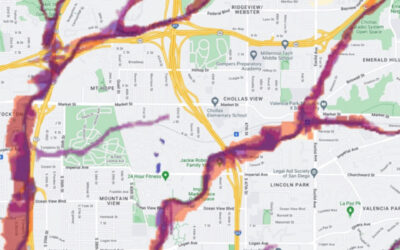

All US states are at the risk of flooding. According to statistics, about 25 percent of the flooding events take place outside the High Risk Flood Hazard zone. Flooding depends on a number of factors, including amount of rainfall, topography, flood-control measures, land development, and construction measures.

If you live in a low risk zone, it does not mean your home is located in a “no” risk area. Floods, being the most common natural disaster, are capable of causing severe damage, emotionally and financially. In fact, floods have caused more than $24 billion in property damages in the United States for the last decade. Thus it is important to purchase flood insurance, irrespective of your zone or location.

To safeguard your property in the event of an unexpected flood in lower risk areas, you can opt for Preferred Risk Policies, which might cost about $129 annually, including coverage for your belongings. Homeowner’s or property policies do not include flood damage coverage, nor do they cover damage from waves, surface waters, wind-driven water, tidal water, etc.

According to some statistics, a home has a 26 percent chance of flooding during the period of 30-year mortgage.

Affordable Flood Insurance

The NFIP makes affordable flood insurance protection available to homeowners living in participating communities under an agreement, which requires them to adopt a floodplain management building ordinance aimed at reducing financial risk associated with construction in Special Flood Hazard Areas. We are able to secure your policy via FEMA or from private carriers as well.

A Flood Insurance policy offers protection for the home’s foundation as well as the equipment necessary to support the home, including electrical panels, water heaters, and furnaces. Personal belongings in the basement and any improvements done to the basement, such as floors, walls, and ceilings, are not covered in the flood insurance policy.

Thus irrespective of the risk zone, it is highly recommended that property owners have a Flood Insurance policy to safeguard their belongings and property from the risk posed by sudden or unexpected flooding.